News

PM Sogavare Awed by SPBD

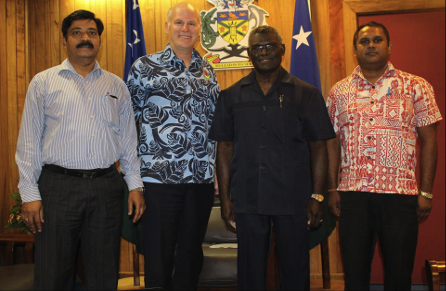

PRIME MINISTER Hon. Manasseh Sogavare has expressed awe at the pace the South Pacific Business Development (SPBD) Microfinance network has taken in advancing its mission to improve the quality of life of financially underprivileged families in Solomon Islands through its microfinance scheme.

The Prime Minister made the remark yesterday when an SPBD delegation paid a courtesy call on him to introduce to him the microfinance scheme’s operation in Solomon Islands. The delegation comprised the US-based founder and President of the microfinancing group himself, Mr. Greg Casagrande and SPBD Microfinance (SI) Limited General Manager, Mr. Muralidhar Anartapur and Finance Manager, Mr. Ronald Vikash Prasad.

Mr. Casagrande said SPBD which has been operating in the South Pacific Region for over a decade now, commenced operation in Solomon Islands in 2013. Other pacific nations that SPBD is established are Fiji, Samoa, and Tonga.

He said SPBD operates as a microfinance institution and improves the quality of life of families living in poverty by providing unsecured credit, training and ongoing motivation and guidance to help them start, grow and maintain micro-businesses, build assets as well as finance home improvements and childhood education.

Mr. Casagrande said the difference between SPBD and the commercial banks is that it goes out to the villages every week to visit its clients and provides them financial and business training.

“The difference between us and the banks is that we go to the villages every week to visit our clients. We know about our clients and care about them. We provide them with financial business training. We teach them to record their daily business revenues. We help them dream and to achieve their dreams.”

He said since SPBD began operation in Solomon Islands, it has provided SBD $20.4 million in microfinance loans on Guadalcanal including Honiara where its operation currently covers.

Mr. Casagrande said as at 31st May 2015, the number of women provided microenterprise development and literacy training reached 5,581 whilst women having savings accounts totaled to 3,409.

He said they have plans to expand their operations to the Western Province and eventually the entire country on province-by-province basis.

The SPBD founder and president said SPBD provides a monthly report on its operation in Solomon Islands to the Central Bank of Solomon Islands.

He said he believes with the Solomon Islands Government support, this microfinance lending institution would be able to grow much wider and quickly and immensely assist in financial empowerment.

Mr. Casagrande said in Tonga and Fiji, the development banks there work through SPBD in providing microfinance services to the rural populace and they just wait to have their interests and principles paid on time.

In response, Prime Minister Sogavare said, “It’s amazing, what you have told me about your operation here in Solomon Islands and other pacific countries where you are also operating.”

The Prime Minister said the Democratic Coalition for Change Government is working towards reviving the Development bank of Solomon Islands and would love to work with the SPBD.

“We would want to ensure those who are lend money when the DBSI is restored to be successful in their business endeavours and would love to work with you. You have a better way of channelling financial assistance to the rural dwellers. We’ll start talking. We’ll let you come to Caucus and explain how your microfinance scheme works. I am indeed so impressed by what you are doing to empower the financially underprivileged,” he added.

Source: Island Sun Download the Article